The Truth About Rolling Over Your 401( k) To A Gold Ira

Rollover 401k To Gold Ira is actually a well-known means to diversify your retirement collection as well as defend your savings coming from rising cost of living and also market volatility. Having said that, there are some necessary points to know about the procedure just before you decide.

What Is A Gold Ira?

A gold IRA is a self-directed IRA that allows you to purchase bodily gold bullion. Gold IRAs are actually tax-advantaged, implying that your contributions and profits expand tax-deferred until you withdraw them in retirement.

Advantages Of Rolling Over Your 401( k) To A Gold Ira

There are many potential benefits to surrendering your 401( k) to a gold IRA:

Diversity: Gold is actually a beneficial resource that is certainly not correlated along with the stock exchange. This indicates that incorporating gold to your collection can help to decrease your overall danger.

Rising cost of living defense: Gold has actually traditionally held its own value effectively throughout time frames of rising cost of living. This makes it a good hedge against the increasing expense of lifestyle.

Tax benefits: Gold IRAs offer the very same tax conveniences as typical and Roth IRAs. This indicates that your additions and profits develop tax-deferred until you withdraw all of them in retirement life.

Dangers Of Rolling Over Your 401( k) To A Gold Ira

There are likewise some possible dangers to take into consideration before rolling over your 401( k) to a gold IRA:

Charges: Gold IRAs usually have greater expenses than typical and also Roth IRAs. This is given that gold IRA managers need to hold and cover your bodily gold.

Assets: Gold may be less fluid than other resources, including equities and connections. This implies it may take longer to offer your gold if you need cash money swiftly.

Dryness: Gold prices could be volatile, implying that they can easily rise and fall hugely. This could possibly bring about reductions if you sell your gold at the incorrect opportunity.

Is Actually A Gold Ira Right For You?

Whether or not a gold IRA is right for you depends on your personal situations and assets goals. If you are trying to find a method to expand your portfolio and guard your cost savings from inflation, a gold IRA may be actually an excellent option. However, it is important to evaluate the dangers as well as benefits properly prior to deciding.

Below are actually some additional factors to always remember if you are actually looking at rolling over your 401( k) to a gold IRA:

Not all 401( k) considers permit roll-overs to gold IRAs. You will definitely require to consult your strategy supervisor to see if you are eligible.

You have 60 days to finish a roll-over. If you carry out certainly not place the funds coming from your 401( k) in to your gold IRA within 60 days, you are going to undergo income tax obligation and also a 10% very early drawback penalty if you are actually under grow older 59 1/2.

You will certainly require to pick a trusted gold IRA custodian. There are various gold IRA business on the market, so it is vital to accomplish your investigation as well as choose a firm that possesses a really good track record.

Popular Investment Options In A Gold Ira

The moment you have actually decided to surrender your 401( k) to a gold IRA, you are going to require to decide on which gold expenditure alternatives to put your amount of money in. One of the most prominent gold IRA investment choices include:

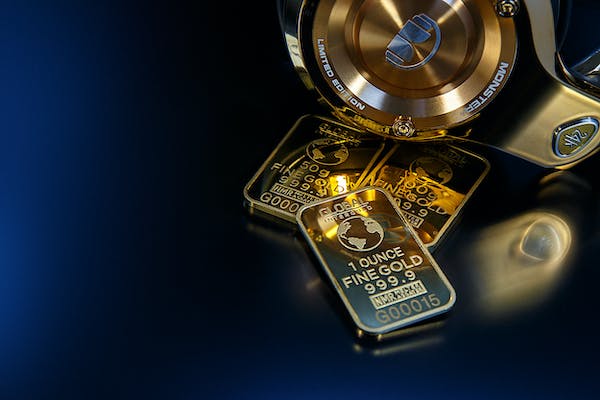

Gold bullion: Gold bullion is physical gold such as pubs or even coins. Gold gold is the best well-liked gold IRA investment option given that it is easy to deal, and it is highly liquid.

Gold ETFs: Gold ETFs are exchange-traded funds that track the cost of gold. Gold ETFs are actually a more economical way to invest in gold than gold bullion, and also they are a lot more liquid. Having said that, gold ETFs are not physical gold, therefore you will definitely not have the capacity to take physical belongings of your gold if you need to.

Gold exploration stocks: Gold mining equities are shares in providers that mine gold. Gold exploration equities can be a riskier financial investment than gold bullion or even gold ETFs, yet they likewise possess the ability for greater profits.

Tax obligation Considerations

Going over your 401( k) to a gold IRA is a tax-free activity. Having said that, there are some income tax considerations to remember:

Required minimal distributions (RMDs): If you are over grow older 70 1/2, you will definitely be called for to take RMDs coming from your gold IRA yearly. RMDs are actually taxed as common earnings.

Early withdrawal fines: If you take out funds from your gold IRA before age 59 1/2, you may undergo a 10% early drawback penalty.

Picking A Gold Ira Custodian

When picking a gold IRA manager, it is essential to consider the subsequent factors:

- Image: Choose a gold IRA protector that has an excellent credibility and also has actually been in business for a number of years.

- Fees: Compare the charges demanded through various gold IRA managers.

- Expenditure possibilities: Make sure that the gold IRA manager gives the gold expenditure alternatives that you really want.

- Customer support: Choose a gold IRA protector that delivers really good customer care.

Verdict

Rolling over your 401(k) to a gold IRA can be a good way to expand your retired life collection and safeguard your financial savings coming from rising cost of living and also market dryness. Nonetheless, it is vital to consider the risks as well as advantages carefully just before making a decision. You ought to also see to it that you opt for a reputable gold IRA custodian.